While Easier Credit is Likely Ahead, Aspiring Franchisees Still Rely Most on Personal Savings for Their Business Startups

By: Michael Alston for Franchise Insights

July 24, 2024 — With persistently higher interest rates and tighter credit, aspiring franchise owners look to diverse sources for financing their startups, especially from their own sources of capital, including personal savings, retirement funds, and home equity.

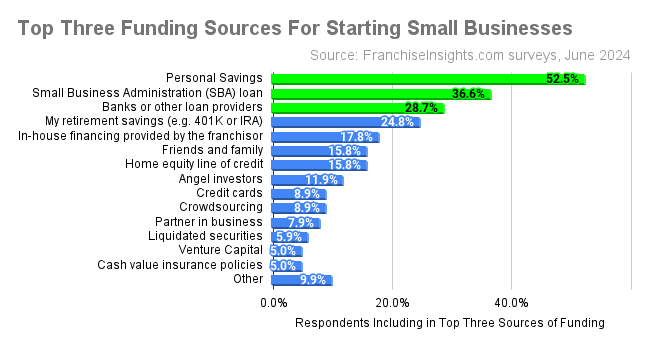

Franchise prospects said they expect “personal savings” to make up the majority of funding for their business launches, as cited among the top three sources by 52.5% of respondents in a June 2024 survey. Those planning to take advantage of Small Business Administration loans and bank loans stood at 36.6% and 28.7% respectively. Another 17.8% of respondents are hoping to take advantage of in-house financing by the franchise that they seek.

The rankings for the top three sources are in line with data from November 2023, when “personal savings” was the most often source selected, at 44.8% of respondents, followed by SBA and bank loans.. Similarly in July last year, personal savings was at the top of the list of franchise funding sources at 51.3%.

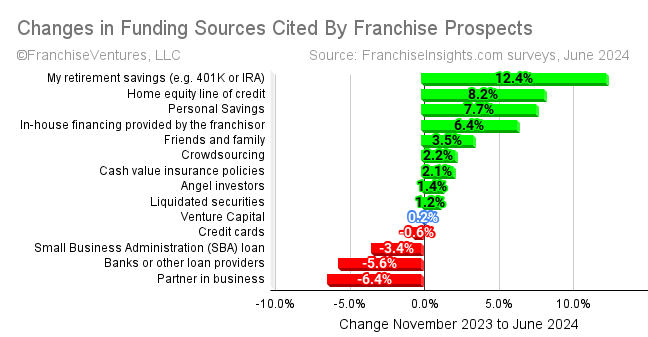

The category of “my retirement savings” grew the most from November, rising from sixth to fourth place with a 12.4% gain in mentions. Coming in fifth place was “in-house financing from the franchisor” cited by just under 18% of respondents.

Though “home equity line of credit” was cited by only 15.8% of respondents to rank seventh in June 2024, that was more than a doubling of November’s 7.6%. “Banks or other providers” and “partner in business” dropped the most as categories, but only by 5.6% and 6.4% respectively.

These results are according to surveys of aspiring business owners conducted by FranchiseInsights.com in June 2024. The total percentages above add up to more than 100% since respondents were instructed to choose their top three sources.

The “other” option was chosen by 9.9% of respondents. The top “other” sources cited were as varied as “employment income”, “grants”, “inherited IRA” and “sale of home,” among many more.

Funding remains a top concern of aspiring franchisees, as 66.7% cite it as a key startup concern in the June 2024 Small Business Startup Sentiment survey.

As measures of inflation eased last week, the Federal Reserve is more likely to lower its lending rates in 2024 which may encourage banks to do the same. Leverage to make a considerable investment and the tax deductibility of business interest go a long way to explain the recurring incidence of debt among the top three sources of startup capital.

FranchiseInsights.com conducts a monthly “mystery shopping survey” as well as the Small Business Startup Sentiment Index™ (SSI) of individuals who have recently inquired about businesses for sale. The most recent Startup Sentiment Index™ and “mystery shopping” surveys were conducted in June 2024. Responses related to financing were collected from both instruments.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Wednesday, July 24th, 2024.