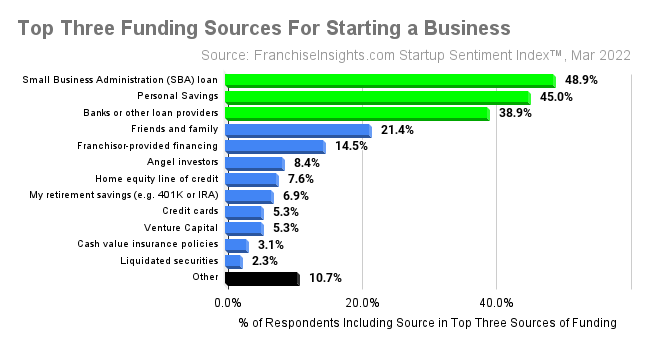

SBA Loans and Personal Savings Are Top Two Sources Expected for Funding Business Startups

March 16, 2022 — Most aspiring franchise buyers plan to use Small Business Administration loans and personal savings to start their businesses, at 48.9% and 45% respectively, according to the FranchiseInsights.com Small Business Startup Sentiment survey. Loans from banks or other lending institutions were identified as the third most common source at 39.8%. The percentages add up to more than 100% since respondents were instructed to choose their top three sources.

The “other” option was chosen by about 11% of respondents. The top “other” sources cited were “funds from a business partner” and “crowdfunding”, which will be choices added to future surveys.

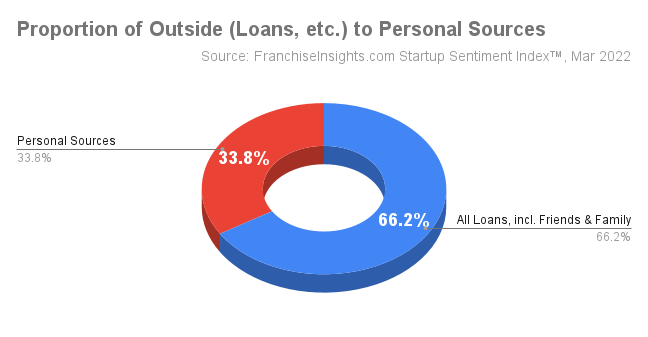

By aggregating sources into two buckets, we see that entrepreneurs are assuming that about one third (33.8%) of startup capital sources will be personal. The remaining 66.2% of sources will come from outside their balance sheets. “Other” sources were excluded from this view.

Personal Sources – for this analysis include personal savings, retirement funds (401K or IRA), credit cards, cash value insurance policies, and liquidation of securities. Though home equity lines of credit are technically a loan secured by the home, it was included for this analysis since it represents buyer equity.

Outside Sources – include Small Business Association (SBA) loans, banks or other loan providers, franchisor financing, venture capital, angel investors, and friends and family.

Undoubtedly the reliance on debt sources for startup capital is related to the decades-low interest rates experienced in the last few years in the United States. It will be interesting to see how this changes in future surveys as the Federal Reserve begins tightening through interest rates this week and reduction in its balance sheet holdings of government debt over time.

FranchiseInsights.com compiles monthly the Small Business Startup Sentiment Index™ (SSI) of individuals who have recently inquired about businesses for sale.The most recent Startup Sentiment Index™ survey was conducted February 24-28, 2022.

Download a copy of the February 2022 FranchiseInsights.com SSI report here. See excerpts from prior SSI™ surveys and subscribe to receive the Small Business Startup Sentiment Index™ monthly report when it is released.

The Small Business Startup Sentiment Index™ is based on a monthly survey of individuals who have recently inquired about businesses or franchises for sale on the digital assets of FranchiseVentures.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Wednesday, March 16th, 2022.