Top 2023 Predictions For Franchise Lead Generation

By: Michael Alston for Franchise Insights

January 11, 2023 – It’s a new year, with new opportunities for franchise growth ahead. Yes, there are economic, legislative and regulatory headwinds, but who would bet against the collective entrepreneurial spirit, creative energy and grit of the franchise community?

With our broad and unique perspective on the flow of prospects and the key ingredients of franchise lead generation, here are a few predictions for 2023. The pandemic is no longer a major consideration for aspiring franchise owners, who are more concerned about getting funding in the face of rising interest rates and tight money.

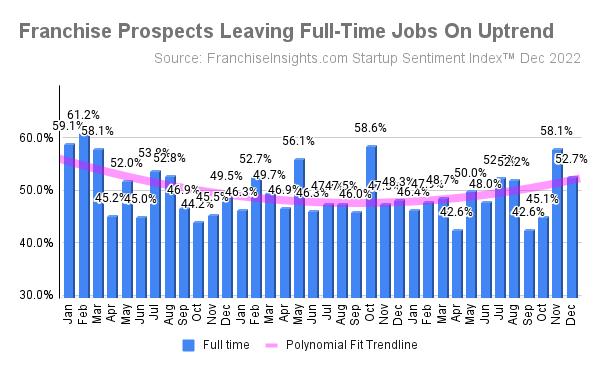

Competition With Employers Will Decrease – In 2022, franchise systems faced increasing pressure from desperate employers who increased pay and offered flexible work conditions to retain or add team members during the pandemic. But an indication that trend is reversing appeared in the last several months, as unemployment edged up, and the percentage of prospects leaving full-time employment increased as seen in the chart below. In the November 2022 Startup Sentiment survey, full-time franchise inquirers made up over 58% of survey respondents, with another 8% having a part-time job.

For Many Reasons, Lead Costs Will Increase – The pitfalls of Meta and Google were exacerbated by increasing demand from growing franchise development budgets as systems competed for a limited supply of the best prospects. We wrote about decreasing lead volumes at Facebook/Instagram compounded by increasing competition and pay per click prices at Google as marketers tried to compensate – even amidst an advertising recession. Add to those 2022 worries the increasing time spent on TikTok, which has driven Meta and Google to distraction – and to product changes that make it harder to target future buyers of franchises.

But the biggest impact on volume and targeting came from Apple’s unilateral App Tracking Transparency measures (“ask app not to track” prompts for each download) that crushed retargeting of prior visitors and discovery of similar targets across platforms like Meta, Google and everywhere else in the digital ad ecosystem.

Unfortunately, the net result for marketers is less transparency (reduced measurements), diminished retargeting, lower click volumes, and ultimately – higher prices. This will continue in 2023.

Further, Microsoft pushed Google, arguably the leader in artificial intelligence, back on its heels by announcing investments in Open AI and unveiling a ChatGPT feature in its Bing search engine. Consumer adoption rates (and cannibalization of Google’s dominant search share) remain to be seen. The biggest impact may be how Google’s implementation of generative AI changes the composition of search results and advertising options thereon.

Privacy Issues Will Become Paramount – One thing that our divided government seems to agree on is that consumers need more privacy protection and control of their data. Now states are moving ahead of the federal government with a patchwork of legislation. California, Virginia, Colorado, Connecticut, and Utah have already passed related legislation, and Michigan, Pennsylvania, and Ohio, among others, are considering similar laws.

Unfortunately, many of the harmless targeting techniques that actually help consumers avoid seeing a bunch of ads they are not interested in look invasive to some of our officials, so this situation is likely to get worse. Google has already taken action to reduce keyword visibility to search marketers. Along with less ability to target across the ad ecosystem, all marketers will need to comply with a thicket of state, federal and international data protection laws. Advertisers will be limited to the first-party capabilities of each provider (Google, Meta, etc.). First party data has and will become a LOT more valuable…

Targeting Capabilities Will Be Further Diminished – Email marketing faced degradation as Apple implemented MPP privacy measures that crippled measurement metrics and geographic targeting. Third-party cookies used to target and personalize web experiences are now blocked by Mozilla and Safari browsers, and Google with about 70% browser share says it will now phase them out of the Chrome browser in 2024. Apple’s “App Tracking Transparency” initiative crushed retargeting visitors from third party sites and apps Retargeting and “similar market” discovery options will continue to exist for first party visitors who have already visited Google, Facebook/Instagram, or your own site, but you will no longer be able to target prior visitors or “similar markets” across platforms.

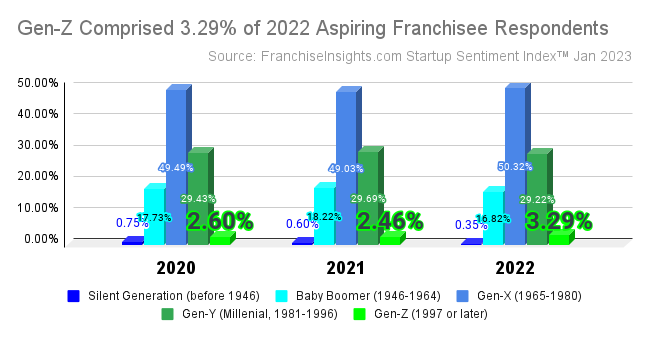

Gen-Z Prospects Will Grow – This one has significant long term implications for franchise lead generation because of the unique media preferences and habits of individuals in this generation who are currently aged 11 to 26. As Google and Meta take on TikTok, expect to see more short-form videos preferred by Gen-Z showing up, for example, in Google search results and as Instagram reels. YouTube is the second most searched site, and ranks second behind TikTok for minutes of usage.

Gen-Z made up 3.29% of our monthly Startup Sentiment Survey respondents in the full year of 2022, a 33.7% increase from 2021. Nothing will keep that cohort from growing in 2023, and in the next twenty years, the leading edge of this cohort will be in the prime years for entrepreneurship and franchising.

The arc of efforts to improve consumer privacy, from Apple’s features that impair email measurement and block “unknown” callers, to legislative actions in response to concerns over social media and consumer data privacy will continue to bend towards more restrictive targeting. On the other hand, the digital advertising ecosystem is working hard to create effective alternatives, and will likely succeed.

We periodically review what demographics say about the coming decades of franchise growth. While there are many factors — political, economic, regulatory, societal — that influence the preference for franchises over employment or other forms of business ownership, as seen above, the sheer number of individuals with the knowledge, drive and financial assets to start a business is a tide that is surely rising.

In the coming weeks, we will continue to update you on developments and offer suggestions to stretch marketing budgets and use them more effectively in 2023 and beyond.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Wednesday, January 11th, 2023.