STATE PROFILE: South Carolina Ranks No. 4 in Franchise Interest Index™ with Strong Retail and B2B Interest

June 30, 2020 – Entrepreneurial spirit is alive and well in South Carolina, where potential franchisees were active enough to rank the state at No. 4 in per-capita Franchise Interest Index™ in 2019.

June 30, 2020 – Entrepreneurial spirit is alive and well in South Carolina, where potential franchisees were active enough to rank the state at No. 4 in per-capita Franchise Interest Index™ in 2019.

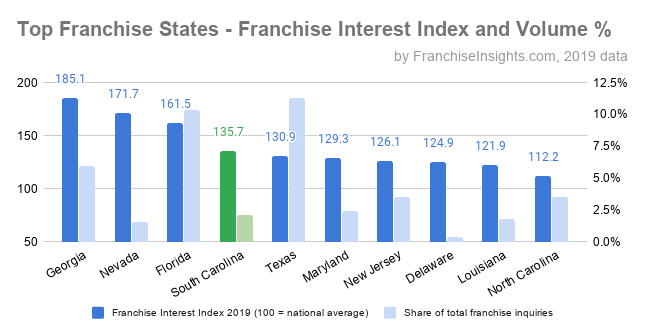

The Palmetto State is the nation’s 27th largest by adult population, with 4.8 million adults over the age of 22. But it generated 1.8% of the prospects who contacted U.S. franchises through the FranchiseVentures demand-generation platform in 2019. On a per-capita basis, that is 35.7% higher than the national average, ranking South Carolina fourth, between two much larger Southern states – Florida at No. 3 and Texas at No. 5.

Retail and B2B Franchises Draw Above-Average Interest in South Carolina

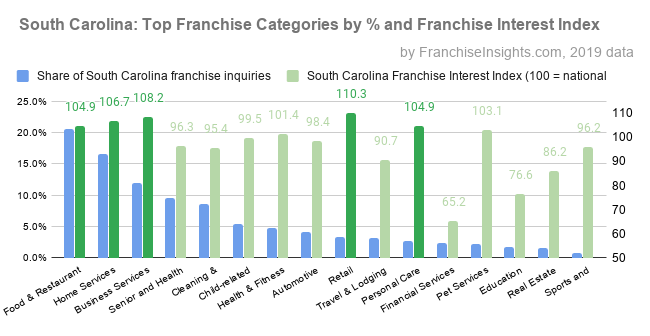

- Top Franchise categories ranked by volume – The most-requested businesses by total volume in Florida mirrored overall trends for top categories of franchises, with Food and Restaurant franchises as the most popular, attracting 20.6% of the inquiries in 2019, followed by Home Services franchises at 16.6% and Business Services at 11.9%.

- Top categories by relative interest – The share of prospects interested in Business Services was 8.2% higher than the national average, strong enough that South Carolina ranked No. 4 for Business Services franchises among states with more than 2 million in adult population. Relative interest in Retail franchises was even higher, accounting for 3.4% of the state’s investment inquiries, and indexing 10.3% more than the national average. South Carolina also indexed high for Home Services franchises (6.7% more interest than average), Food and Restaurant franchises (4.9% more interest than average), and Personal Care franchises (2.7% share of inquiries, 4.9% more interest than average).

Demographic Profile of Potential Franchise Buyers in South Carolina

Here is a demographic profile of South Carolina prospects who contacted franchisors through the FranchiseVentures demand-generation platform in 2019:

- Age – Generation X prospects, ages 39 to 54, comprised 45.1% of South Carolina adults making an investment inquiry to a franchise last year. Baby Boomers were 26.5% of South Carolina prospects, and Millennials aged 23- to 38-years old were 21.4% of the total, or 3.2% higher than the national average.

- Household income -28.6% of South Carolina prospects have household income of $100,000 or more, and 62% are married.

- Homeownership – 78.3% of prospects in South Carolina own a home, and 69.2% have been in residence for 5 years or longer.

- Home value is estimated over $250,000 for 33.7%, and over $500,000 for 6.2% of prospects.

- Liquid assets – 26.4% had income-producing assets over $75,000, and 4% had liquid assets over $500,000.

Top Franchise Categories in South Carolina, 2019

| Share of South Carolina franchise inquiries |

South Carolina Franchise Interest Index (100 = national average) |

|

|---|---|---|

| Food & Restaurant | 20.6% | 104.9 |

| Home Services | 16.6% | 106.7% |

| Business Services | 11.9% | 108.2% |

| Senior and Health Care | 9.5% | 96.3% |

| Cleaning & Maintenance | 8.6% | 95.4% |

| Child-related | 5.4% | 99.5% |

| Health & Fitness | 4.7% | 101.4% |

| Automotive | 4.1% | 98.4% |

| Retail | 3.4% | 110.3% |

| Travel & Lodging | 3.2% | 90.7% |

| Personal Care | 2.7% | 104.9% |

| Financial Services | 2.3% | 65.2% |

| Pet Services | 2.3% | 103.1% |

| Education | 1.8% | 76.6% |

| Real Estate | 1.6% | 86.2% |

| Sports and Recreation | 0.9% | 96.2% |

For this analysis, Franchise Insights combined proprietary data from the FranchiseVentures’ demand-generation platform with demographic data from Alliant, a leading provider of U.S. consumer audience targeting and data enrichment and predictive analytics.

Franchise Ventures is the leading franchise lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

Interested in more insights from our proprietary data set? Subscribe here to make sure you hear about them first.

Contact Franchise Ventures to get your share of today’s aspiring franchise owners.

Published on Tuesday, June 30th, 2020.